Insurance fraud is a significant and escalating problem worldwide, costing the industry massive losses annually. According to the Coalition Against Insurance Fraud, insurance fraud steals at least $308 billion every year across all lines of insurance in the United States. This staggering figure not only impacts insurers’ bottom lines but also leads to increased premiums for honest policyholders. As fraudsters become more sophisticated, insurance companies must adopt advanced technologies to combat fraud effectively. Developing robust insurance fraud detection software is essential for protecting the industry’s financial integrity and preserving customer confidence.

The sheer scale of insurance fraud underscores the urgent need for effective detection mechanisms. SAP reports that fraudulent claims can account for up to 10% of an insurance company’s incurred losses and loss adjustment expenses. These figures highlight the critical importance of implementing advanced fraud detection solutions to mitigate financial losses and protect consumers.

Traditional manual methods of fraud detection are no longer sufficient to combat the increasingly complex schemes employed by fraudsters. Advanced software solutions powered by AI and ML have become essential in identifying patterns, anomalies, and potential fraud cases that human analysts might miss.

Fraudulent activities have evolved, with perpetrators using complex schemes that are hard to detect using traditional methods. Organized fraud rings and cyber fraud have become more prevalent, making it increasingly challenging for insurers to identify fraudulent activities without sophisticated tools.

Insurers deal with vast amounts of data daily. This extensive and diverse information—ranging from structured to unstructured data—presents significant challenges in manual analysis and fraud pattern identification.

Overly sensitive detection systems may incorrectly flag legitimate claims as fraudulent, causing customer frustration and increasing costs. This high rate of false positives diverts resources from investigating actual fraud cases.

The integration of advanced technologies, particularly AI, has revolutionized fraud detection in the insurance industry. AI offers several improvements:

AI can sift through vast volumes of data to pinpoint unusual patterns or outliers that could signal potential fraud. This proactive approach helps insurers stay ahead of evolving fraud tactics.

Unlike conventional rule-based systems, AI adapts dynamically to changing circumstances and novel fraud schemes. Continuous learning from processed data makes AI increasingly adept at combating new threats.

AI enables rapid data processing and evaluation, allowing insurers to make instant decisions. This quick response helps prevent fraud attempts before significant losses occur.

As AI refines its algorithms through iterative improvement and self-learning, it reduces false positive alerts, streamlining fraud detection processes and saving valuable time and resources.

Implementing advanced fraud detection software offers numerous benefits:

Automation of manual processes leads to cost savings and reduced human error rates, resulting in more efficient operations and lower overhead expenses.

Enhanced detection capabilities lead to more accurate identification of fraudulent claims, reducing false positives and focusing resources on genuine cases.

Automated fraud detection measures expedite claim approvals and rejections, leading to quicker resolution times and improved customer satisfaction.

Ensures adherence to strict regulatory standards regarding privacy, security, and transparency by monitoring transactions for suspicious activity and maintaining accurate records.

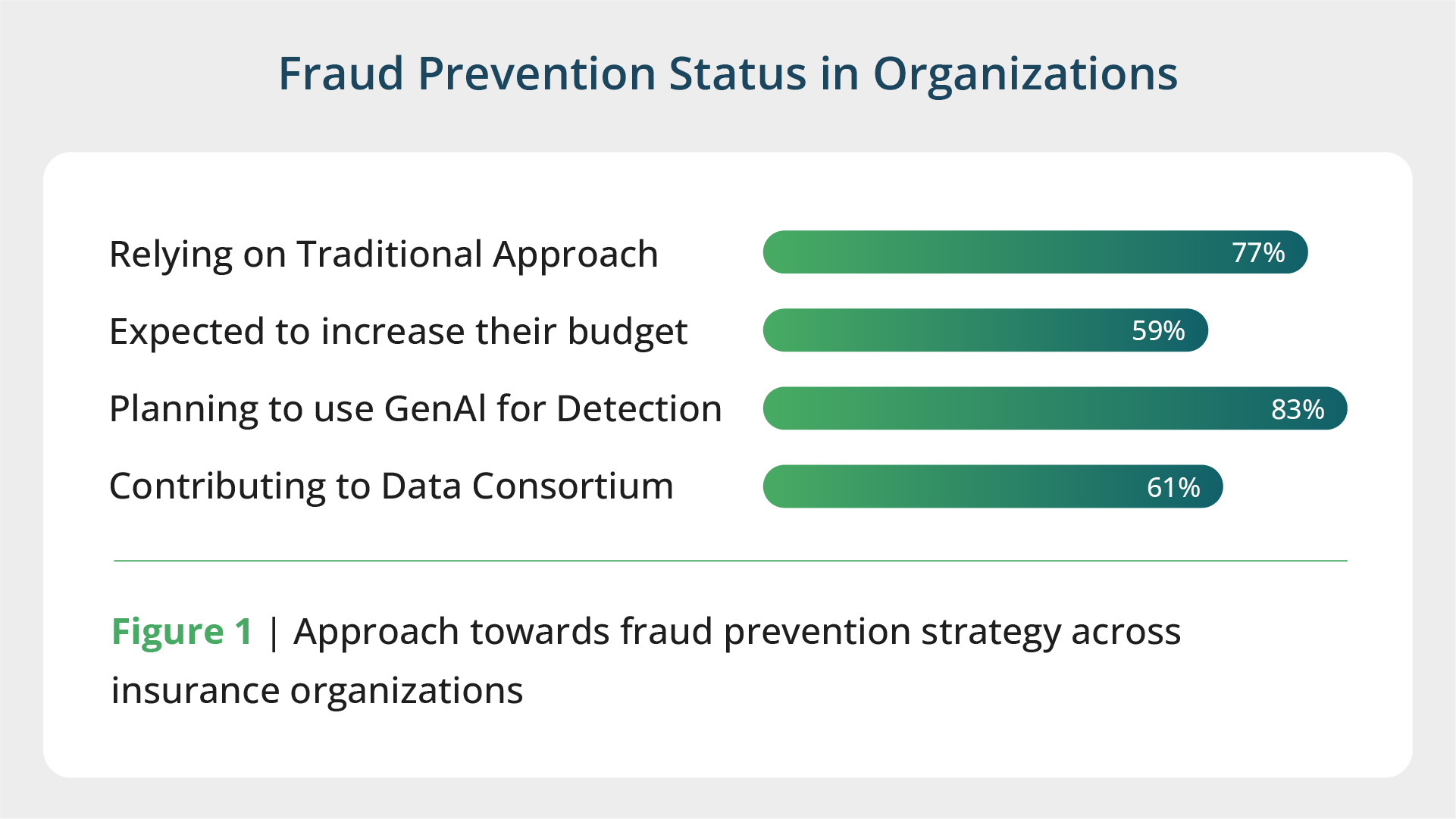

While many companies are still using traditional methods, there’s a significant shift towards more advanced and collaborative approaches.

Source: Infosys

Creating effective insurance fraud detection software requires a structured approach encompassing several key stages. This process integrates technical expertise with industry-specific knowledge to produce a solution that addresses current needs and anticipates future challenges.

This initial phase involves identifying specific fraud challenges and defining clear objectives. It requires engagement with key stakeholders from claims, IT, legal, and compliance departments to ensure a comprehensive understanding of organizational needs.

During this stage, features and capabilities are defined based on organizational requirements and industry best practices. The appropriate technology stack, including AI and ML frameworks, databases, and tools, is selected to form the foundation of the software.

This critical phase involves aggregating data from all relevant sources and meticulously labeling it to ensure accuracy for ML models. The quality and comprehensiveness of this data directly impacts the effectiveness of the final product.

The software takes shape during this phase, with the building and training of AI algorithms for fraud detection and the development of the application’s frontend and backend components.

Comprehensive testing includes functional verification of each component, performance assessment to ensure the system can handle expected data volumes, and user acceptance testing to incorporate end-user feedback.

This phase marks the transition to real-world application, involving integration with existing systems and comprehensive staff training to ensure effective utilization of the new tools.

An ongoing phase, this involves continuous improvement through regular model updates with new data and provision of technical support and troubleshooting.

Throughout the development process, customization is crucial. The software must be tailored to address specific insurance products and fraud types relevant to the organization. Building with scalability and flexibility in mind ensures the system can adapt to future needs and emerging technologies.

At Kanda Software, we understand the complexities involved in developing robust insurance fraud detection software. Here’s how we can assist:

We bring deep domain knowledge and technology expertise in AI and ML to develop solutions capable of detecting complex fraud patterns.

We tailor our software development to your specific needs, ensuring seamless integration with your existing systems and processes.

Our development approach prioritizes regulatory compliance and robust security measures to protect sensitive data.

We offer ongoing support to keep your fraud detection systems updated with the latest technologies and adaptive to evolving fraud schemes.

If you’re looking to improve your insurance fraud detection capabilities, our team of experts is ready to assist. Contact Kanda Software to discuss your fraud prevention needs with our specialists.

Developing robust insurance fraud detection software is a critical step in combating the significant financial losses caused by fraudulent activities. By integrating advanced technologies like AI and ML, insurers can enhance detection accuracy, improve efficiency, and protect their customers.

At Kanda Software, we specialize in creating custom solutions tailored to your organization’s unique needs. Our expertise in software development ensures that we can transform your concepts into powerful tools against insurance fraud. Contact us today.