September 05, 2024

Finance and Banking

Integrating AI-Driven Customer Service and Support in Banking

Imagine a world where you don’t have to wait on hold for your financial question to be answered, or where your personal financial advisor is only a tap away and available 24/7, or where you receive immediate alerts about suspicious transactions. That’s not wishful thinking, that’s what AI-driven customer service in banking looks like.

As the landscape of customer expectations keeps evolving, the banking industry faces increasing pressure to keep up. Technological advancements in different domains have set new benchmarks for convenience and efficiency, and customers now expect the same from their financial institutions. And that’s where AI steps in, bridging the gap between traditional banking services and modern consumer demands.

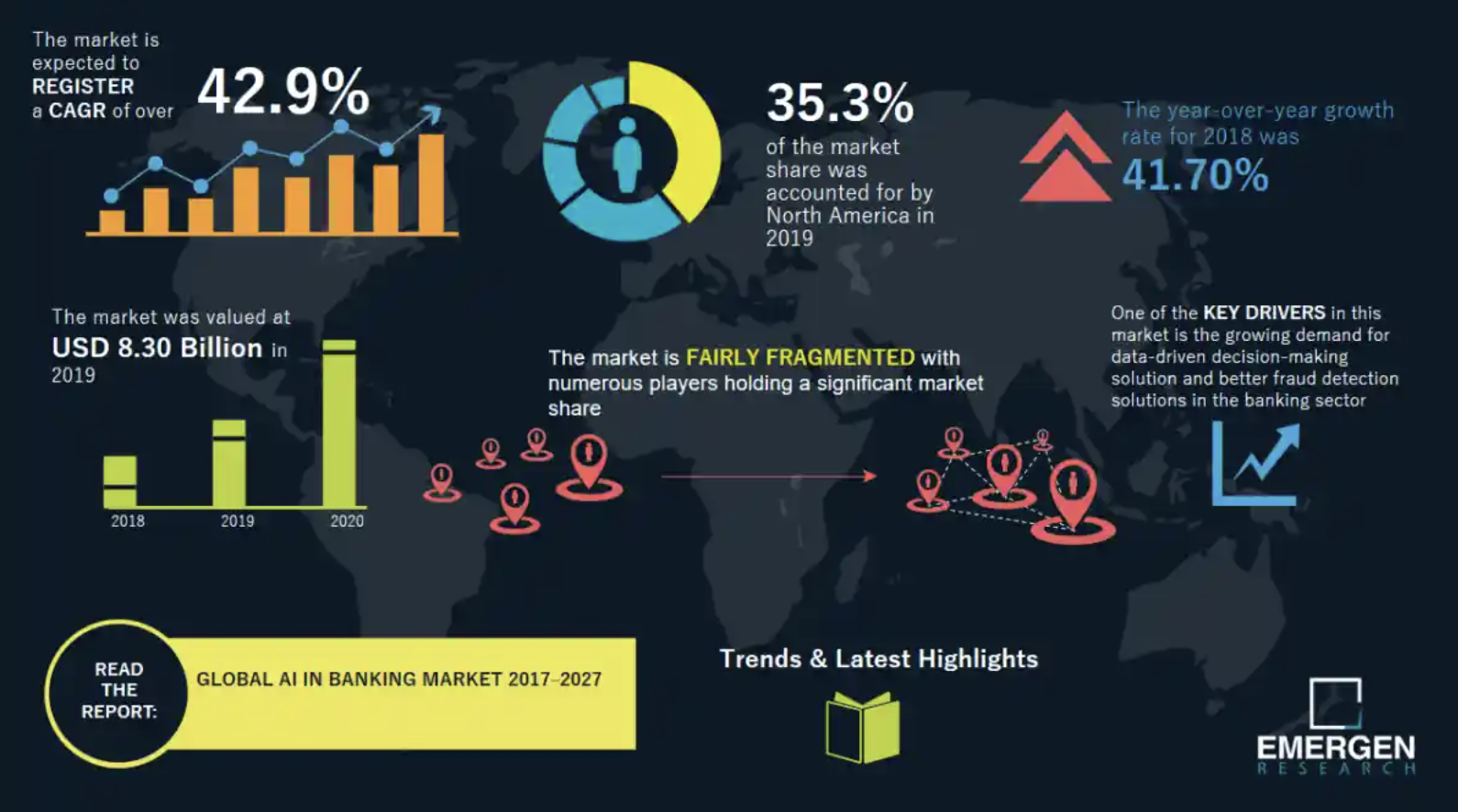

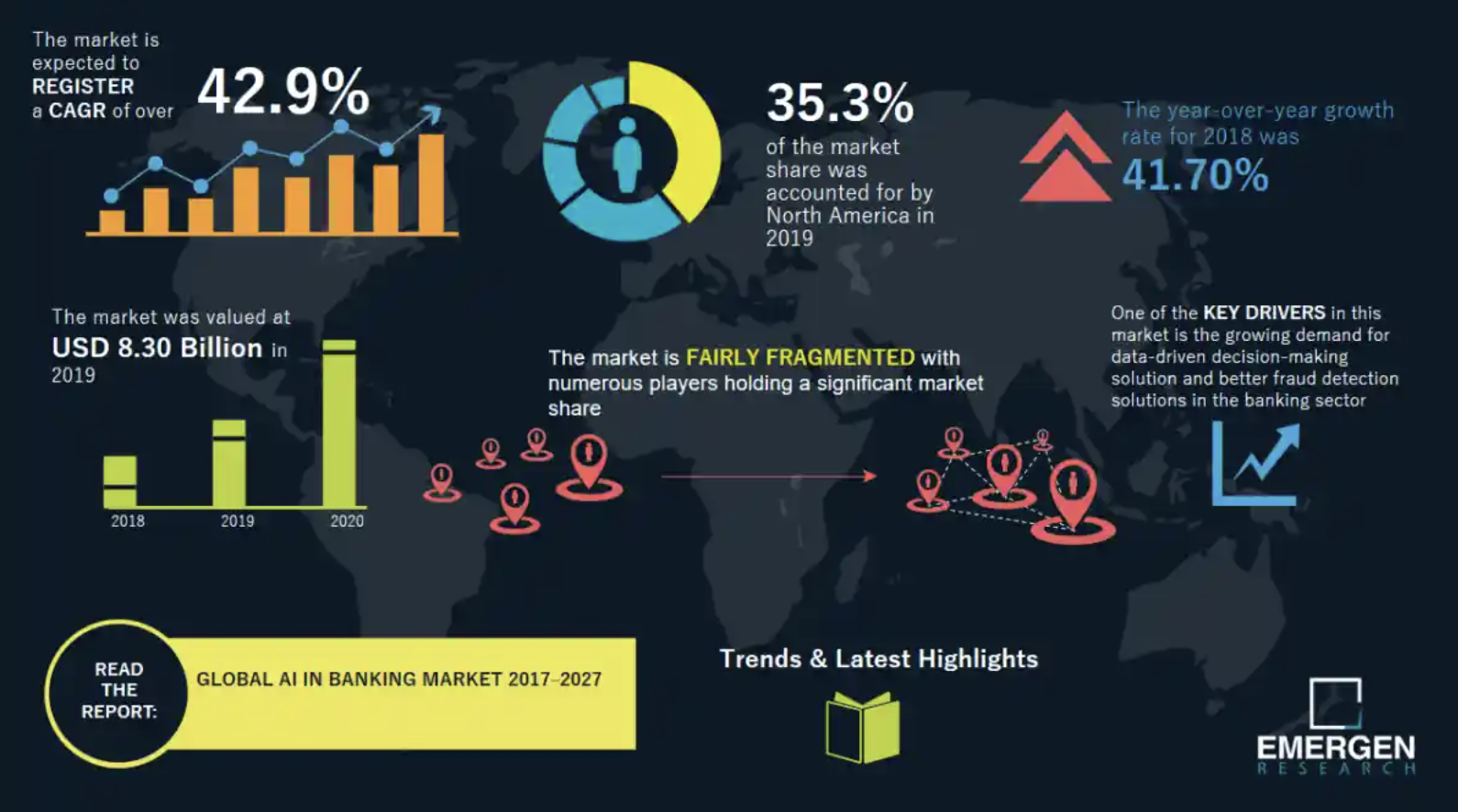

Source: Emergen Research

This explosive growth is driven by the multiple advantages that AI brings to both back and front-office operations. Today, let's focus on one of the most impactful areas — the benefits of AI in customer service in the banking sector.

Source: Emergen Research

This explosive growth is driven by the multiple advantages that AI brings to both back and front-office operations. Today, let's focus on one of the most impactful areas — the benefits of AI in customer service in the banking sector.

How is AI changing customer support in banking?

Nothing showcases the revolutionary potential of AI in banking quite like the numbers. The market for AI technologies in banking is expected to reach $130 billion by 2027, growing at a staggering CAGR of 42.9% from 2019 to 2027. Source: Emergen Research

This explosive growth is driven by the multiple advantages that AI brings to both back and front-office operations. Today, let's focus on one of the most impactful areas — the benefits of AI in customer service in the banking sector.

Source: Emergen Research

This explosive growth is driven by the multiple advantages that AI brings to both back and front-office operations. Today, let's focus on one of the most impactful areas — the benefits of AI in customer service in the banking sector.

- Improved convenience: Working around the clock, AI-powered solutions can provide consumers with much-needed assistance at any time of the day or night. The almost instantaneous speed of responses also contributes to consumer convenience.

- Operational efficiency: By automating and streamlining many routine customer support processes, AI in banking allows employees to concentrate on more complex tasks, leading to a more efficient service overall. In addition, AI-driven tools can handle growing volumes of inquiries without additional costs, making them a scalable option.

- Personalized customer experience: With the ability to analyze consumer data, AI algorithms can empower banks with a deeper understanding of customer habits and preferences. Armed with these insights, financial services providers can tailor their services accordingly and build even stronger relationships.

- Enhanced security: AI solutions enhance security by monitoring financial activity in real time, allowing for the rapid detection of suspicious transactions. This approach helps protect customer accounts and minimize financial risks.

What kind of AI do you need?

AI encompasses a wide range of technologies, from natural language processing and large language models to speech recognition and computer vision, each designed to achieve specific objectives. The key to selecting the right AI-driven solution lies in understanding what you aim to accomplish. Are you seeking to get a deeper understanding of your customers' journeys and needs? Or do you want to enhance customer service by reducing wait times for common inquiries while maintaining high engagement levels? If you need help identifying and implementing the best AI solution to elevate your customer service, talk to our experts. Let’s explore the most common types of AI solutions in the banking industry that take customer service to the next level.Chatbots

Chatbots are perhaps the most common application of AI in customer support. By leveraging natural language processing, chatbots can offer quick and accurate responses to customers’ questions, altering the entire dynamic of customer interactions. In a world where immediacy is important, chatbots can save time and improve overall satisfaction. Case in point. Major banks have already implemented chatbots into their operations. A notable example is Erica, the virtual assistant launched by Bank of America in 2017. Since its inception, Erica has become one of the most popular AI-powered chatbots, engaging with 32 million customers. Erica helps clients access their cash flow data, balance information, money transfer details, and much more.Robo-advisors

While chatbots handle routine customer interactions and help with basic tasks, robo-advisors provide automated financial planning and investment management services. They heavily use sophisticated ML algorithms and data analytics to provide personalized financial advice and manage investment portfolios based on individual customer profiles. The future of the robo-advisory market is bright — by 2025, the assets managed with the help of robo-advisory services are expected to rise to $16 trillion. Case in point. Schwab Intelligent Portfolios is one of the most well-known robo-advisors that assists users in managing their diversified portfolios based on personalized goals and risk tolerance. This innovative service continuously monitors and automatically rebalances portfolios, employs tax-loss harvesting, and provides a range of other features to ensure an exceptional customer experience.Predictive analytics algorithms

Predictive analytics in banking leverages sophisticated AI-powered models and data mining to sift through vast amounts of data, uncover patterns and trends, and predict customer behavior. Armed with these insights, banks can better tailor their services to meet customer needs, predict customer churn, and offer next-best offering (NBO) recommendations through targeted channels. Case in point. AI-driven support extends beyond online interactions to offline services as well. HSBC, for example, developed the AI-powered iCash tool to support its offline customers. This tool provides data-driven forecasting of cash withdrawals, allowing the bank to plan ATM replenishments more accurately and efficiently.Credit risk scoring

Another area where AI is transforming customer service is credit risk assessment. What makes AI-powered credit scoring systems unique is that they can analyze a vast array of traditional data. This can range from income, to financial behavior, credit history, and work experience, as well as non-traditional data points like rent payments, property records, and even social media for a more comprehensive and accurate borrower's creditworthiness evaluation. Case in point. Nubank, a challenger bank from Brazil, has developed its own credit scoring system to make its cards accessible to the unbanked and underbanked. This system incorporates hundreds of variables, from simple indicators like whether a customer thoroughly reads a contract or quickly clicks ‘Yes,’ to more complex behavioral analyses. By leveraging these diverse data points, Nubank's AI-driven system can more accurately assess credit risk, making financial services more inclusive.Potential challenges and roadblocks along the way

The benefits of AI in banking are multifold but successful implementation of AI also greatly depends on addressing challenges like data privacy and security, reliable performance, and seamless integration.Protecting data privacy and security

Given the sensitive nature of financial information, it’s crucial to establish proper safeguards and ensure robust protection of customer data. However, some major AI vendors like OpenAI save user prompts and account information, so there is no guarantee that this data will not be used for training datasets. So, instead of ChatGPT, it may make sense to use an open-source LLM model that you host locally to take full control of your data.Ensuring robust performance

In banking, reliable performance and accurate, quick responses are crucial for maintaining customer satisfaction and operational efficiency. Customers expect immediate assistance, especially for time-sensitive issues like account inquiries. Hugging Face, the AI community that hosts open-source models, offers different leaderboards with benchmarks and ratings across different modalities — an easy way to compare models based on their performance, latency, and other parameters. However, achieving optimal performance does not stop with choosing the right model. Performance optimization is rather an iterative process that involves continuous analysis and fine-tuning. Key optimization strategies include:- Data pre-processing and normalization

- Hyperparameter tuning

- Source code enhancements

- Model pruning, etc.

Overcoming integration hurdles

It’s no secret that banking institutions rely heavily on their business-critical legacy systems which are often monolithic, built on outdated infrastructures, and plagued with data silos. Integrating a new technology can be challenging but that doesn’t mean it is impossible. In some cases, you will need to upgrade your core systems while in others, you may need to implement middleware solutions to act as a bridge between old and new technologies.The bottom line

Integrating AI in the banking industry is never a one-size-fits-all endeavor. Each financial institution has unique needs, a distinct customer base, and operational challenges that require a tailored AI approach. However, when implemented correctly, banks can harness the full potential of AI to transform their customer service operations and drive sustainable growth. Are you ready to use AI to put your customers first? Our AI and ML engineers have the necessary expertise to help you integrate advanced AI capabilities and stay ahead in the competitive banking industry. Describe your idea to us, and we’ll promptly get back to you with a project estimate. Contact us today.Related Articles

IRS Modernization and Taxpayer Expectations: Is Your Firm’s Software Ready?

The Internal Revenue Service is undergoing a major transformation. The changes go far beyond a routine upgrade: they replace the technology that handles 267 million tax returns and generates $5.1 trillion each year.The Inflation Reduction Act, together with the pressing need to retire 1960s-era systems, has pushed the agency into a multi-year, multi-billion-dollar effort. Tax firms should…Learn More

5 Key Steps to Enhance Quality Assurance in Fintech Applications

Today, the financial industry is rapidly changing. From payment processing to wealth management, fintech applications are transforming everything. Between complex financial regulations and the constant threat of cyber-attacks, companies must pay close attention. In response, any new technology needs to maintain both strong security and high quality. According to the American Bankers Association, 93% of…Learn More

The Future of FinTech and Banking with AI, ML, and Blockchain

he financial landscape is on the brink of a revolution, fueled by the combination of artificial intelligence, machine learning, and blockchain technology. According to McKinsey & Company, AI alone could contribute an additional $13 trillion to global economic activity by 2030, highlighting the transformative potential of these technologies in finance. What is the current state and…Learn More

Effective FinOps Strategies to Achieve Cloud Cost Efficiency

As organizations embrace the cloud, the pay-as-you-go model offers scalability; however, controlling its costs goes beyond mere management. In this regard, the FinOps framework serves as a beacon for financial and operational brilliance. In this article, we’ll discover what FinOps is, explore its key benefits and principles, and delve into practical FinOps strategies tailored for…Learn More