April 09, 2024

General

A Strategic Approach to Risk Analytics: Essential Insights for Executives

More and more companies nowadays are applying big data, intelligent tools, and advanced analytics to enhance their decision-making processes, especially when handling factors that may negatively affect a company’s stability.

From artificial intelligence to machine learning to the Internet of Things, companies are leveraging various instruments to improve service delivery. It’s no wonder that the global risk analytics market size is projected to reach $54.95 billion by 2027, with a CAGR of 12.2% during the forecast period.

Risk factors should be analyzed before any emerging issues become too serious, and in turn, the adoption of these robust risk analysis techniques can become transformative for the company.

In this article, we’ll explore what risk analytics is and the steps it comprises, an overview of its benefits in various industries, and key components to be considered by executives to mitigate risks for their companies.

What is risk analytics?

Risk analytics is a set of methods developed to assess, describe, and foresee risks. With everyday reports about leaks, malicious activities, and data theft, the business environment is becoming increasingly vulnerable to threats. Primarily, banking and financial institutions remain the most susceptible to risks. Financial risk analytics helps identify, measure, and manage the risks that have the potential to disintegrate the financial stability of an organization. Risk analytics creates a responsive and adaptable analytical framework to track and monitor data by providing a 360-degree view of the business’ state, enhancing transparency, and prompting self-service reporting and analysis. In the financial sector, for example, it helps perform analyses within asset classes such as equity, debt, and other investments, in order to mitigate any risks associated with intended harmful acts.Most common industries that use risk analytics

Let's take a closer look at some key industries where risk analytics is particularly useful:-

Banking, Financial Services, and Insurance (BFSI)

-

Government

-

Telecommunications

-

Healthcare

Key benefits of risk analytics

There are several key benefits of risk analytics for companies:-

Reduced costs

-

Combating frauds

-

Long-term planning

7 steps in setting up a risk analytics system

When managing medium to large size businesses, risk analysis becomes complex since each department has its own viewpoint and perspective of business operations. As a result, the only solution is for organizations to streamline their risk management and have a single source of truth for risk-related data. The following are the seven steps to follow in implementing risk analytics in an organization with multiple departments and siloed data:-

Step 1: Build a comprehensive risk library

-

Step 2: Review and validate data sources

-

Step 3: Consolidate data sources

-

Step 4: Automate testing

-

Step 5: Visualize

-

Step 6: Report

-

Step 7: Scale

To sum it up

As businesses continue to strive for the right balance between innovation and growth, the need for advanced analytics tools will only increase. From banking and financial services to government sectors, telecommunications, and healthcare, the applications of risk analytics are vast and far-reaching. By leveraging risk analytics, organizations can identify and minimize risks, securing their financial and operational integrity. Kanda helps companies build complex risk analytics systems based on the unique requirements of organizations from various domains and sizes. With over 20 years of experience in data analysis and software development, we are able to provide top-notch, highly sensitive solutions through the use of innovative technologies. Talk to our experts and start your journey to a more secure future with us.Related Articles

Comprehensive AI Security Strategies for Modern Enterprises

Over the past few years, AI has gone from a nice-to-have to a must-have across enterprise operations. From automated customer service to predictive analytics, AI technologies now handle sensitive data like never before. A Kiteworks report shows that over 80% of enterprises now use AI systems that access their most critical business information. This adoption…Learn More

Building Trust in AI Agents Through Greater Explainability

We’re watching companies leap from simple automation to an entirely new economy driven by self-governing AI agents. According to Gartner, by 2028 nearly a third of business software will have agentic AI built in, and these agents will be making at least 15% of everyday work decisions on their own. While that can significantly streamline…Learn More

Machine Learning for Fraud Detection: Evolving Strategies for a Digital World

Digital banking and e-commerce have changed how we transact, creating new opportunities for criminals. Businesses lose an estimated $5 trillion to fraud each year. The sheer number of fast-paced digital transactions is too much for older fraud detection methods. These traditional tools are often too slow and inflexible to stop today's automated threats. This new…Learn More

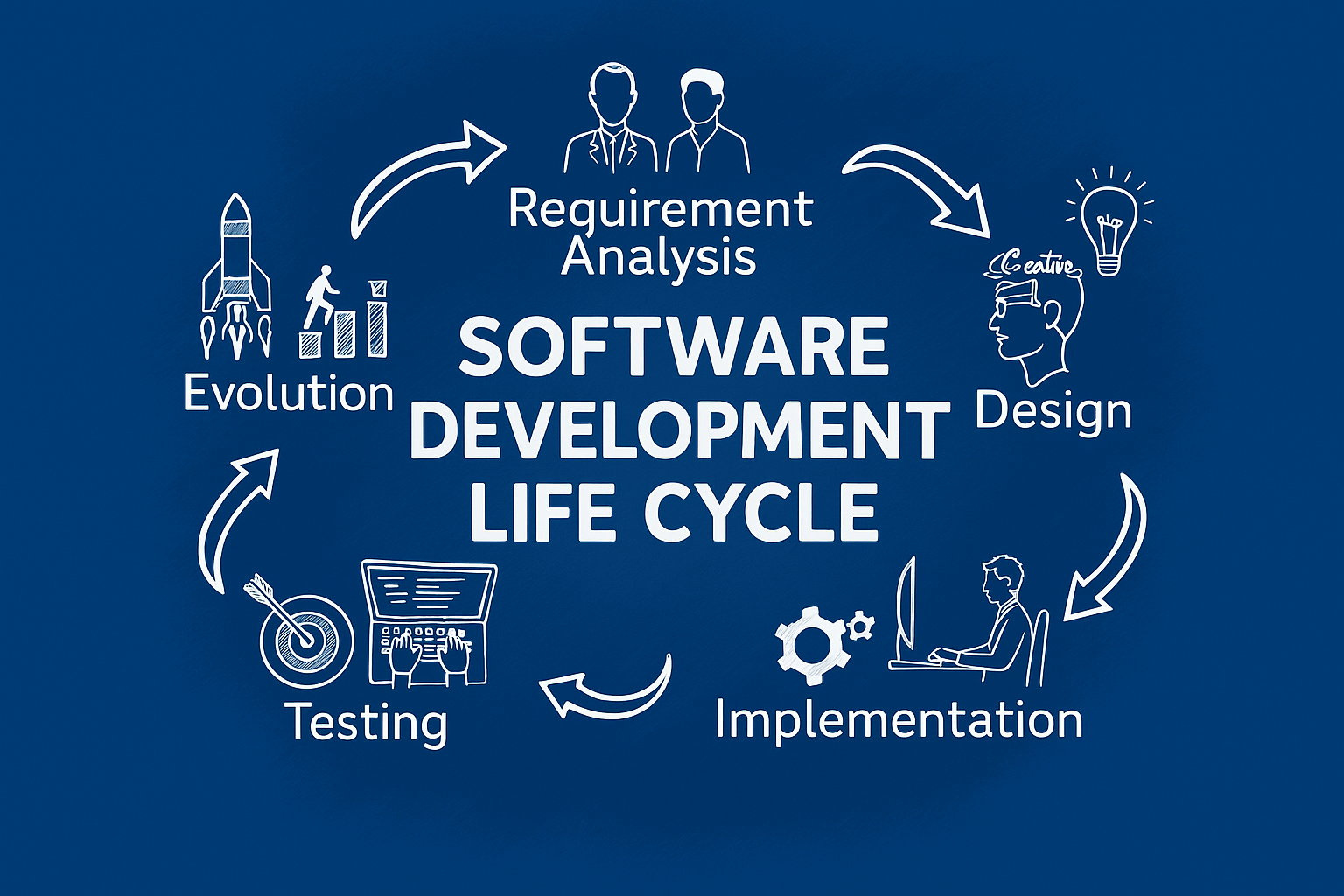

Software Development Life Cycle (SDLC): Helping You Understand Simply and Completely

Software development is a complex and challenging process, requiring more than just writing code. It requires careful planning, problem solving, collaboration across different teams and stakeholders throughout the period of development. Any small error can impact the entire project, but Software Development Life Cycle (SDLC) provides the much needed support to overcome the complexities of…Learn More