In Healthcare and Life Sciences, Artificial Intelligence (AI) seems perpetually poised for a dramatic breakthrough – forever on the verge of toppling barriers of acceptance and adoption.

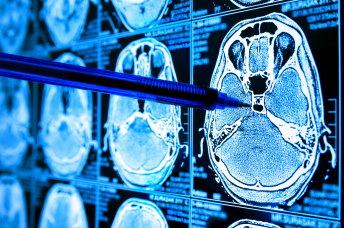

Recently, a number of factors are increasing the pressure on health systems to accelerate adoption of AI-powered image processing to assist clinicians with detection and diagnosis of disease.

AI isn’t just one technology, it encompasses a wide array of algorithms vying for market share in healthcare. As 2021 approaches, a number of opportunities are emerging for application developers and technology buyers alike. Due in part to the convergence of the Covid-19 outbreak, a growing shortage of diagnostic clinicians, and maturing machine-learning toolsets, AI-powered image processing is quietly becoming a frontrunner in the race to wider adoption.

AI has demonstrated a remarkable ability to detect anomalies in medical imagery that even human clinicians can’t see. These are image classification applications, powered by deep neural networks (DNNs), that require models to be trained from large image datasets. But once they’re trained in focused diagnostic use cases, they routinely outperform their human counterparts in both speed and accuracy of detection.

Those facts alone suggest AI will help drive earlier detection, reduce diagnostic errors, and ultimately liberate clinicians from the more tedious, time-consuming tasks in the radiology workflow.

Many successes to date have been in the context of clinical trials and proofs of concept. But the underlying technologies, market perceptions, and regulatory requirements are continually evolving, and for developers willing to take the plunge, the flow of venture funding to healthcare AI is only accelerating.

Sizing up the market

Healthcare and Life Sciences organizations have been notoriously slow to adopt AI solutions, even as other verticals eagerly put AI at the hub of their technology strategy.

Still, venture capital investment in healthcare AI has been far less hesitant. According to Rock Health, a health technology venture fund, just under $2 billion was invested in AI healthcare solution developers in 2019.

McKinsey and Company notes that in January 2020, total investment in the top 50 developers of AI solutions in healthcare hit the $8.5 billion mark.

And recent pre-COVID forecasts suggest that the market, for AI-driven image diagnostics specifically, will be $1.5-$2 billion by 2024, up from around $400 million in 2019. But the COVID-19 pandemic appears to be accelerating that investment trend. And it’s noteworthy that AI imaging solutions have already been deployed to help identify the presence of the virus in lung scans.

In parallel to the admittedly slow but improving adoption by the healthcare industry, the overall AI investment trends are promising. There’s increasing interest from venture capital, and that’s important because developing AI solutions for healthcare means facing a gauntlet of challenges that require adequate funding from the start.

Understanding payoffs for Healthcare and Life Sciences

Despite the hurdles to implementation, the speed, accuracy, and sensitivity of AI image analysis can significantly streamline the radiology workflow, reducing the total time consumed at every step in the process while promoting patient comfort and safety along the way.

The benefits typically touted by clinical AI advocates are something like:

- Improving patient outcomes

- Improving efficiency and lowering costs

- Reducing diagnostic errors

That’s about as vague as it gets, so it’s worth a closer examination of the mechanics that can actually bring the marketing-speak to fruition.

For instance, an important hot button for healthcare organizations is misdiagnosis. Up to 10% of patient deaths are the result of diagnostic errors, and somewhere between 3% and 6% of image analysis by radiologists contain clinically significant errors.

The accuracy of AI has the potential to greatly reduce costly human errors in both detection and diagnosis. That can result from a workflow that uses AI to pre-screen images and flag potentially urgent issues, or from post-screening images to catch anomalies missed by clinicians.

Lesser Known Benefits

Some specific mechanisms innate to DNNs also contribute to the realization of better patient outcomes, lower costs and improved efficiencies.

Among other artifacts of DNN algorithms is their extreme sensitivity to very subtle differences in values across datasets. Translation? When the data in question is a medical image, DNNs have an uncanny ability to differentiate anomalies from anatomy in even very low-contrast images.

That trait produces some key follow-on benefits, perhaps none as dramatic as AI’s speed and accuracy, but no less compelling:

- Earlier Detection

AI can see things even the most experienced clinicians can’t. A recent NYU study found that a clinician assisted by AI performs better than either one on their own, when it comes to finding anomalies early in mammograms. That includes reducing false negatives that can cause critical delays in treatment.

- Reduced Scan Duration

Shaving time from the radiology workflow doesn’t just happen after the image is captured. The ability of AI to differentiate anomalies from anatomy in low-contrast images can enable a significant reduction in the duration of the scan sessions and therefore in an associated radiation dose.

- Reduced Radiotracer Dosage

Imaging technologies require patients to ingest contrast agents to help clinicians spot differences between tissue. In PET scans radio tracers are injected into patients to provide contrast between different types of tissue. But AI can enhance contrast digitally, enabling a significant reduction in both the dose of contrasting agents and radiation from the scan itself.

- Reduced Need for Invasive Procedures

False positives can trigger a needless order for tissue samples or more expensive and invasive procedures. The pathologist’s mantra, tissue is the issue, has been the trusted rule when it comes to confirming a diagnosis. Until now, no other technology has had the same potential as AI to disrupt that. Some imaging systems have been characterized as providing ‘virtual biopsies’, providing confident diagnosis, while foregoing additional costs of invasive procedures.

- Freeing Up Resources

Obviously, faster image processing has the effect of freeing up clinicians for other, higher level tasks. Just as importantly, the ability to get sufficient contrast from shorter scans reduces the demands on imaging devices, giving administrators and management finer control of scheduling, and reducing the wait time for patients.

- Clinician Wellness

Multiple studies suggest that radiologists feel their workload is increasing. Reducing demands on radiologists and pathologists, especially the most tedious and time consuming tasks, can reduce stress and increase job satisfaction and retention.

Building Value into Your Solution

Consider these benefits in the context of your solution design and feature set. A clear understanding of how the customer might assess value will help focus your solution on what matters. AI that can literally replace or reduce costly processes in healthcare, or directly bolster the bottomline, will of course command a higher price and higher priority in the marketplace.

To better understand how AI fits into real world settings, it’s worth a closer look at some specific uses of AI-powered imaging at the point of care.

Use Cases

By now it should be clear that deploying AI doesn’t replace experienced radiologists. Its role is to reduce their workload, provide support in the reading room, and help catch issues missed, or misidentified, by the clinician.

That said, more than one expert has cautioned that radiologists who use AI will replace radiologists that don’t. In an age where radiologist shortage is adversely affecting care and increasing critical delays in detection and diagnosis, it’s increasingly difficult for healthcare decision makers to ignore the potential to support radiologists with a competent and tireless technology like machine-learning.

Sample applications

As impressive as the success stories of clinical AI can be, their performance isn’t uniform across all diagnostic contexts. AI is just better suited to some use cases than others. At least for now. But in the right scenarios, it can be game-changing.

AI can detect everything from fractures to tissue anomalies like lesions and tumors. Let’s look at some examples of the most promising use cases.

The Path to Implementation

Although AI is still in its infancy in healthcare, the competition is stiff, and often well-funded, and the barriers to entry remain high for all players.

Understanding the market opportunity, the potential use cases, and how the industry measures benefits is a good start to making informed product decisions. Another foundational insight is recognizing the many diverse disciplines required to develop products in this arena. That’s why the key to success lies, in part at least, in finding the right channel and development partners and leveraging existing tools to accelerate development.

The value of Channel Partners

Connecting with channel partners who have strong, established relationships in healthcare can jumpstart the new relationships you’ll need down the road. The channel both represents your product after development, and helps provide insights into their customer base upfront. They can help take the guesswork out of design by identifying real-world needs and stakeholder concerns that inform your product decisions from the beginning.

Some of the big players in AI also offer partner programs specifically for healthcare developers — Google, Microsoft Azure, and AWS can all help promote solutions built on their platform.

They may also be able to assist with the logistics of clinical trials and planning the path to regulatory approval.

If you build the right product, your channel partner has every incentive to assist with all aspects of implementation. About the only thing channel partners won’t do is develop your application.

Partnering with Experienced Healthcare Developers

Launching development with the right partner from the start is critical. That doesn’t just mean a development team with experience in AI, but one with the expertise and track record in AI, in healthcare, and in the agile and rigorous devops practices that ensure everything remains on track.

Tools that Jumpstart Development

By now the landscape of tools and data needed to build fundamental AI capabilities is both broad and deep. Libraries like TensorFlow, and libraries built on top of it, like Keras and TFLearn, can greatly accelerate development by handling the more tedious low-level processing of building neural networks.

Tools like NVIDIA DIGITS can accelerate training of deep neural networks (DNNs), particularly those used in image classification. In 2019, NVIDIA also introduced Clara, a set of development tools for AI that are specific to healthcare and even address HIPAA and similar regulatory concerns.

The Bottomline

Clinical image analysis is hardly the only development opportunity in healthcare AI. But for all the reasons discussed, it’s reaching an interesting convergence point on both the buyer and developer sides of the equation.

The allure of the marketplace and the increasing availability of development tools doesn’t mean there aren’t plenty of implementation and regulatory challenges. Among them, managing the intricacies and conflicting goals of multiple stakeholders and building relationships that encourage buy-in.

And despite all the toolkits, libraries, and healthcare-specific frameworks emerging into the marketplace, there’s no substitute for building a strong multi-disciplinary team with all the necessary expertise on board.

Any product strategy that values speed to market requires finding a development partner with deep experience in both AI and healthcare — one that comes pre-assembled, and ready to hit the ground running.